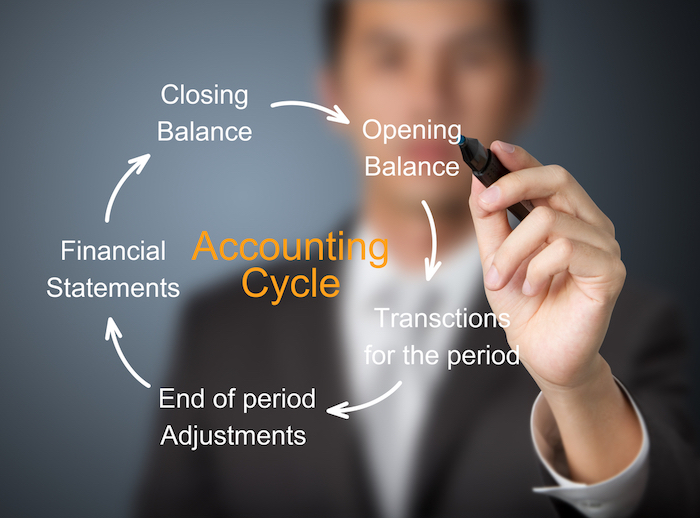

Managing your cash and cash flow is essential as a small business. It’s the key to preventing your business from failing while showing you opportunities for growth. Understanding your opening and closing balance is a vital part of cash flow management, as it covers the money that’s coming into and going out of your finances.

It’s your first time doing the accounts for your new business, or perhaps it’s the start of a new financial year. You’ve heard about something called an opening balance, but you’re not quite sure what it is or how and when to use it.

In this post, we’ll talk about what your opening balance is and when and where to enter it into your accounts. Because your opening and closing balances are usually linked, we’ll cover how to treat your closing balances too. With this info, you’ll be confident about what to do at the start or end of your financial period.

What is an opening balance?

As you might expect, opening balance and closing balance are very different. Your opening balance is how much money your business has at the start of a specified accounting period. That could be a day, a week, a month, every quarter, or by year.

For businesses that have been operating for a while, working out your opening balance is a straightforward way to analyse business performance. It can also be used to provide clear and transparent answers to your investor or the taxman.

Quite simply, the opening balance of an account is the amount of money, negative or positive, in your account at the start of the accounting period. The overwhelming majority of the time, this will be the amount of the closing balance from the previous period brought forward.

For example, the balance in your bank account at the end of your last accounting period, say December the 31st, was €2,000. This is your closing balance. On the 1st January, we are starting a new accounting period.

Our opening balance for the new period is the €2,000 brought forward from our closing balance.

Many accounts in your financial records, such as your bank or individual suppliers, will have closing balances at the end of your accounting period. When you start a new period, make sure to carry closing balances forward to become opening balances.

What if I have started a new business? What are my opening balances?

Of course, for new businesses that are either about to launch or have only been trading for an extremely short period, the opening balance will be the first figures added to your accounting software. That could include money that you’ve received from a bank, angel investor, some other form of accessible funding, or simply the savings that you’re using to launch your business.

If you are starting your accounts for your very first accounting period as a new business, you will not have many opening balances to enter into your accounts as there will be nothing to carry over from a previous accounting period. Some people starting a new business will have no opening balances to enter at all.

However, depending on the timing and how you’ve set up your business, you may need to enter some opening balances to correctly show investments made into the company and other initial transactions. Here at Big Red Cloud, we recommend checking with your accountant if you are unsure, as they will have direct knowledge of your unique business.

What is a closing balance?

Your closing balance is the positive or negative amount remaining in an account at the end of an accounting period. Once all of the transactions you need to record for that period, whether cash or credit, are entered into your accounts, you are left with your closing balance. This is what you bring forward to the new period as your opening balance.

So if you’re considering the financial period to be one month, you will need to look at your balance sheet at the end of every month. Whatever the number is at the end of the month after all your sales have been recorded and all your payments have been made, that is your closing balance. You will then transfer that closing balance to next month’s balance sheet, which will become the opening balance for that period.

Failing to include opening balances will mean that your figures will be off for your accounting period, so always remember to enter your closing balances and carry those forward when you start a new set of accounts. Failing to do so means that you will find it harder to create a cash flow forecast that can change the way you operate your business.

What are opening balances and closing balances used for?

While the opening and closing balance are important, it’s the opening balance that will ensure that your accounts are always accurate. They can then be used to monitor your historical financial records.

For example, the year-end accounts for your business won’t just show your annual profits for the year. You can use them to view the accumulated profits from all of the years you’ve been operating, including your assets, such as your bank balance and your liabilities, like loan repayments.

Without an accurate opening balance, even the best accounting software in the world will be limited in what insights it can show you. Without monitoring your opening balance, you’ll have little understanding of your running totals from financial period to financial period.

Use your opening and closing balance

The more you understand your opening and closing balances, the more valuable they’ll become. They’re a way of regularly checking the financial status of your business and a signifier of how well everything is going so far. You can gain insights that can open up new growth opportunities or get a warning signal if things aren’t going as well as hoped.

By using your opening and closing balance with Big Red Cloud, you’ll get those insights in an easy to understand way. That will make planning for your next steps significantly easier. If you need any help, our support team is always ready to answer your questions. Contact the team at Big Red Cloud to find out more about how we can help ensure you’re using your opening and closing balance to get the answers and the insights you need.